Section 179 Tax Write Off | BUY A NEW FORD & GET A BIG WRITE-OFF

What is the Section 179 Deduction?

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. This deduction helps businesses lower their taxable income by writing off the entire cost of these items in the year they are acquired, instead of depreciating them over several years.

How Section 179 Works in 2024:

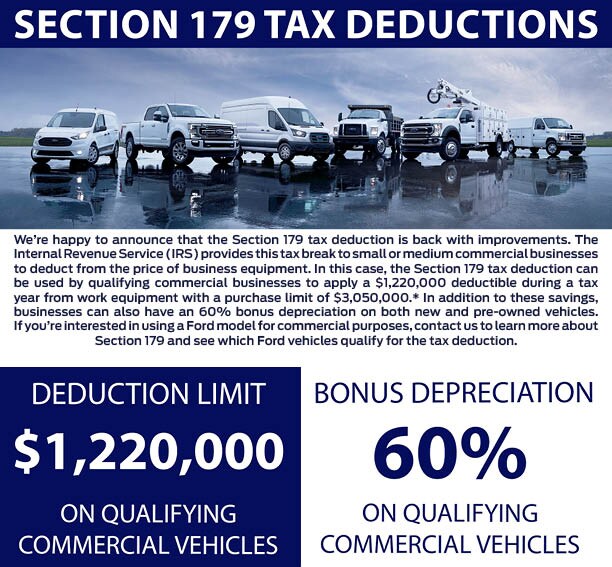

For the 2024 tax year, businesses can deduct the full purchase price of qualifying equipment up to a limit of $1,220,000. This provides an immediate financial benefit, encouraging businesses to invest in necessary equipment sooner rather than later. Most small and medium-sized businesses will be able to write off the entire cost of their qualifying purchases on their 2024 tax return, subject to limits.

Limits of Section 179 for 2024:

- Deduction Limit: The maximum deduction a business can take under Section 179 in 2024 is $1,220,000

- Spending Cap: The deduction starts to phase out on a dollar-for-dollar basis after a business spends more than $2,890,000 on qualifying equipment. The entire deduction is phased out when total purchases reach $4,050,000.

- These limits make Section 179 particularly beneficial for small and medium-sized businesses.

Who Qualifies for Section 179?

All businesses that purchase, finance, or lease new or used business equipment during the 2024 tax year generally qualify, as long as their total spending on qualifying items is below $3,050,000.

What Qualifies for Section 179?

Most tangible goods used by businesses in the U.S., including off-the-shelf software and business vehicles (with certain restrictions), qualify for the Section 179 deduction. To take advantage of this tax break, the qualifying equipment and software must be purchased and placed into service between January 1, 2024, and December 31, 2024.

In summary, for 2024, businesses can deduct up to $1,220,000 in qualifying purchases, with the deduction starting to phase out once total equipment costs exceed $3,050,000. This makes Section 179 a powerful incentive for companies to invest in equipment and software.

Contact

Frederick Ford Inc.

26905 Sussex Hwy

Seaford, DE 19973

- Sales: (302) 629-4553

- Service: (302) 629-4553

- Parts: (302) 629-4553